by Ken Pisani

Before he was a Presidential Medal of Freedom recipient and progressive icon of the Supreme Court, he was a good man in a seedy Chicago ruled by cronyism. The corruption case that made Justice John Paul Stevens.

On the evening of June 19, 1969, attorney John Paul Stevens was playing catch with his youngest daughter, Sue, on the lawn of his home in Chicago’s modest Beverly neighborhood when the phone call came that would change his life.

Across town, Stevens’s beloved Cubs had just returned home after suffering a string of defeats on the road. These were the Cubs Stevens, 49, knew best: perennial losers, a ballclub that serialized disappointment across decades. Yet Stevens was not without hope: the Cubs currently led the National League East, and in each toss to his young daughter the lawyer could allow himself to dream of the Cubs’ first World Series in more than two decades.

Maybe it was a year for hope. In exactly one month, Apollo 11 would depart for the moon. One month after that, the Woodstock music festival would be winding down “Three Days of Peace and Music” at a farm in upstate New York.

Stevens’s wife, Betty, beckoned him inside. He strode past his older daughters, Kathryn and Elizabeth, prone on their bellies and watching television in the manner of American teenagers. The ABC Evening News that night carried five different stories on Vietnam—each one a disconcerting reminder that their 20-year-old son, John Jr., recently drafted although not old enough to vote, would soon be deployed in the conflict.

The phone call was from the president of the Illinois Bar Association who, along with the president of the Chicago Bar, had been tasked with forming a Special Commission to investigate allegations of bribery and misconduct by justices on the Illinois Supreme Court. According to the bar president, they needed a “fearless and impartial” attorney to lead the investigation and had zeroed in on Stevens—quietly respected but little known.

Stevens, ear pressed to the phone, knew what they really needed: some damn fool who believed enough in fairness and due process to commit what would likely amount to career suicide. For an attorney practicing in Chicago who might some day argue a case before the justices, acting as Chief Counsel for the investigation risked making powerful enemies with long memories. As the Chicago Daily News later put it, “It is a job no attorney relishes—a job from which, in fact, numerous lawyers literally ran.”

In a town that famously crushed dissenting voices outside the 1968 Democratic Convention less than a year before, and where the only black defendant in the upcoming trial of the Chicago 8 would soon be shackled and gagged in an American courtroom, the abuse of power against the powerless was a very real circumstance. And it didn’t sit well with John Paul Stevens.

Stevens, whose penchant for bow ties and refusal to bend the rules elicited respect and curiosity in the chummy world of Chicago law, didn’t have to think long. As his family continued its Rockwellian evening routine around him, the square shooter said yes on the spot. He’d later sum up his feelings about the challenge thusly: “If you’re going to shoot at the king, don’t miss.”

Sherman Skolnick was a man who demanded notice. Confined to a wheelchair since childhood, the 39-year-old also sported a top row of protruding teeth and thick glasses in heavy black frames that sat high on his temples. When encountered, he was usually shouting about this conspiracy theory or that political scandal. The eccentric founder of the Citizens’ Committee to Clean Up the Courts, Skolnick, although not a lawyer, had spent years filing numerous lawsuits against public officials and government agencies alleging all manner of malfeasance. His lack of success in these ventures did little to deter his fervor.

Skolnick was an unreliable crackpot, a man who shouted “Fire!” at the first puff of smoke… or even in the complete absence of smoke. But this time, there was indeed an incipient blaze. Skolnick suspected a judge on the Illinois Supreme Court had accepted payment to exonerate a defendant in a case of criminal fraud.

Three years earlier, in 1966, an appeal of People v. Isaacs was before the Illinois Supreme Court. The original charges were a 35-count indictment for state contract fraud against Theodore Isaacs, a politically connected Chicago lawyer and businessman, and former high state official. In March of 1967 the court exonerated Isaacs in what appeared to be a unanimous opinion written by Justice Ray Klingbiel.

Skolnick had recently discovered in public records shares of stock in downtown Chicago’s newly formed Civic Center Bank & Trust Company held in the names of Klingbiel’s grandchildren. That might not mean much to most people, but Skolnick connected this thread to that one and before you knew it, he had linked the stock’s acquisition by Klingbiel to Ted Isaacs—a founder and officer of the Civic Center Bank—while his fraud case was pending before the court.

In essence, Skolnick was suggesting a bribe had taken place. This is how it works, the system of corruption in a city famous for it.

Skolnick wasn’t the most reliable witness. He’d claimed evidence of a failed attempt to assassinate JFK in Chicago by a “second Oswald” three weeks before Dallas, and accused anti-war activist Tom Hayden of being an agent of the CIA. (He’d later claim a commercial airliner crash was deliberately caused to silence witnesses in the Watergate scandal, and that the 9/11 attacks were an “inside job.”) Few experienced journalists would have heeded a tip from Skolnick. Without proof, a newspaper could be sued out of existence. And Skolnick’s evidence was scant.

He was fortunate, then, to come across 25-year-old Ed Pound, a young and hungry reporter for the Alton Evening Telegraph, a town of fewer than 40,000 located miles from Chicago’s infamous corruption. Pound saw in Skolnick “an aggravating gadfly who, in his persistent digging, sometimes hits paydirt.”

Skolnick was happy to bend Pound’s ear about all manner of impropriety in Chicago’s corrupt courts. He also alleged that the current chief justice of the state Supreme Court, Roy Solfisburg, was a secret attorney for that same bank. And Pound’s own quick sleuthing confirmed enough suspicious activity to convince his editor to go to press with front page allegations. The story broke in the Wednesday June 11 edition of the Telegraph. Faced with a major scandal that threatened to paint the entire judiciary as corrupt, the Illinois Supreme Court came up with an idea: a Special Commission to investigate the allegations, one created by and reporting to none other than the court. In essence, the court would oversee its own investigation. Business as usual in Chicago, where dead people sometimes elected politicians, and Chicago Daily News columnist Mike Royko suggested that the city’s official motto, “Urbs in Horto” (“City in a Garden”), should be changed to “Ubi est Mea” (“Where's Mine?”).

This is how it works.

But the court had miscalculated in its attempt to ensure a quick and easy conclusion to the matter. It had designated the president of the Chicago Bar Association to head up the Commission, a position then held by a prominent attorney who knew all the sitting justices and would have been favorably disposed in their favor. However, the favored attorney’s term as President of the Chicago Bar expired as the commission was getting off the ground, and the new president, Frank Greenberg, was no crony. And Greenberg, in seeking a defender of justice to lead the legal investigation into the state’s highest court, couldn’t have chosen better than John Paul Stevens.

While some viewed the allegations with skepticism and others expected nothing to come of any investigation into powerful local figures, Stevens’s sense of public service didn’t allow for either sentiment. He saw his assignment as straightforward: to ascertain the validity of Skolnick’s wild accusations linking the bank stock to the Isaacs case and to the justices who voted to exonerate him. He was to gather evidence, interview witnesses, and report back to the Commission in just six weeks. His first task was to assemble a team.

Kenneth Manaster, a 27-year old Harvard graduate less than a year at his firm, was joined by meticulous young forensic accountant James Nussbaum, on loan from Price Waterhouse. Rounding out the team were twenty-something associates Joseph Coughlin, William McNally, and Nathaniel Sack. Only assistant counsel Jerome Torshen, at age 39 a decade younger than Stevens, had any courtroom experience. With the exception of Torshen, the fledgling lawyers were assigned by their firms, as one later assessed, “as the most expendable lawyer[s]” in their respective offices. This wasn’t an A- or even B-Team; at best they were plucky underdogs in well over their hopelessly green heads. There was no upside here: no extra pay for what would turn out to be sixteen-hour days and seven-day weeks into August, a missed summer in a season of daily miracles at Wrigley Field. And in the early bloom of their legal careers, they faced the prospect of having one day to argue before the state Supreme Court justices they were about to investigate for judicial impropriety.

Stevens’s team also faced withering public criticism. The Special Commission was widely expected to be nothing more than a cover-up of back room Chicago-style corruption. Just five years after passage of the Civil Rights Act, Chicago’s Black population was still conditioned to expect unequal justice—one system for powerful white politically connected men, and another for the poor and disenfranchised. The city’s Black newspaper, the Defender, awarded the Illinois Supreme Court its “Onion for Today,” mocking the “appointment of a Special Commission to ‘investigate’ the alleged wrongdoings of its own membership.”

This is how it works.

Stevens’s team would spend very little time together, scattering across Illinois to attend to different aspects of the investigation. McNally spent much of his time in the state capital of Springfield, digging into court records and archives. Sack and Coughlin researched issues related to the presentation of evidence and the Canons of Ethics regarding judicial conduct. Manaster and Nussbaum were assigned to the Civic Center Bank for a deep dive into documents relating to its formation and the financial records of the parties being investigated. Manaster recalled his nervousness, and Stevens’s attempt to instill confidence in his inexperienced charges by walking them over to the Bank, like “daddy walking his kids to the first day of school,” a calming presence before vanishing.

Despite the confidence he showed before his novice team, for Stevens himself, with a wife and four children and his partnership in a small law firm to consider, this was a lose-lose proposition.

John Paul Stevens knew better than most the costs of an unjust system. He had dedicated his life to law, attending Northwestern University Law School on the GI Bill after serving in the Navy as a code-breaker of Japanese radio transmissions during World War II. Graduating magna cum laude and first in his class, his first job was clerking for Supreme Court Justice Wiley Rutledge during the 1947–48 term. Admitted to the bar in 1949, Stevens returned to Chicago and soon formed his own law firm with two other partners, making a name for himself locally as a first-rate antitrust litigator.

But it was a family tragedy, the wounds from which were still fresh, that cemented his dedication to fairness. In 1926, his family owned and operated the Stevens Hotel, then a Chicago institution that the family had founded with the grit and determination of two generations. Charles Lindbergh stayed there during a national tour celebrating his 1927 flight from New York to Paris. But by 1930, the hotel was in dire straits. The Depression had decimated business and, to shore up its debts, Stevens’s father borrowed money from the Illinois Life Insurance Company controlled by his father, J.W. Stevens, and older brother, Raymond. When business did not improve and the hotel failed, an overzealous state attorney indicted Stevens’s grandfather, father, and uncle on charges of embezzlement.

Stevens’s grandfather suffered a stroke, and Raymond, his uncle, committed suicide. His father was left to face trial alone, and was convicted. That conviction was later overturned by the Illinois Supreme Court—the very institution Stevens was now investigating. The exoneration came too late: the assets of the insurance company had been acquired and the hotel taken into receivership by the government. Years later it became the Conrad Hilton, whose vast, street-level glass windows were famously shattered in a police sweep of protesters at the 1968 Democratic Convention.

The unjust prosecution of his family gave Stevens, as he recounted in his 2019 memoir, a “firsthand knowledge of the criminal justice system’s fallibility,” and no doubt influenced his pursuit of equal justice under the law. The abuse of power was not something that sat well with John Paul Stevens.

He had that in common with Sherman Skolnick, the polio-stricken agitator for justice who discovered what appeared to be a transparent case of bribery in the Illinois Supreme Court. Years earlier, his family’s life savings had been wiped out when a brokerage firm mismanaged money set aside for Skolnick’s future care. Skolnick filed a series of lawsuits, including one that reached the state Supreme Court, which ruled against Skolnick. Among the members of the court: Ray Klingbiel and Roy Solfisburg. That setback turned a victim into a crusader.

Skolnick recalled, “I vowed to my parents that I would devote my life to helping others in the courts.” That he’d discovered a scandal involving two of his prominent, perceived tormentors, Justices Klingbiel and Solfisburg, no doubt delighted him.

Though wildly different in temperament and approach, Skolnick and Stevens found themselves on the same end of a lopsided fight against a system of entrenched corruption.

No one thought they had a prayer.

June 26 was the hottest day of the year in Chicago, with temperatures soaring more than 30 degrees to reach 96. Manaster and Nussbaum were the odd couple beginning a weeks-long lockdown at the bank, Manaster nervous and untried and Nussbaum calm and obsessively systematic. They stared down a conference room at the Civic Center Bank stacked with disorganized files, loose papers, and incomplete corporate records. It was their misfortune to be assigned this sweltering archeological dig while at Wrigley Field, the Cubs were completing a four-game sweep of the Pirates.

Because the Special Commission had subpoena power, the bank was obligated to cooperate but officials there were not pleased with the intrusion. Multiple attempts were made to disrupt their work; perhaps the most creative, as Manaster recalled, was installing a female secretary in a short skirt just outside their door intended to distract both young men from the task at hand.

Somewhere in the document dump of checks, ledgers, stock registers, and inscrutable paperwork would be the key to the whole sordid case: tying the well-connected businessman Ted Isaacs to the transfer of stock to two of the justices who exonerated him of criminal fraud.

Ted Isaacs was an influential Chicago lawyer and key political ally of Illinois Governor Otto Kerner. As campaign manager, Isaacs had helped elect Kerner governor twice, and was rewarded with an appointment as Director of the Illinois Department of Revenue. He was part of a system of prominent men in prominent posts accustomed to free passes and special favors to win their influence. This is how it works.

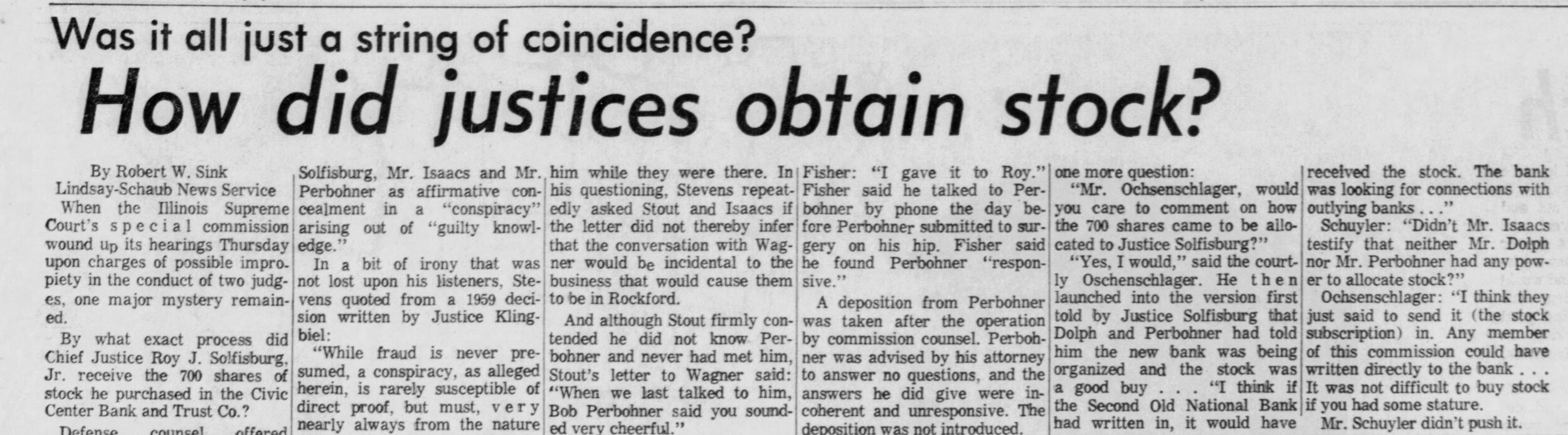

The justices, equally powerful on their perch, denied everything in the press. But those denials proved troublesome enough from the start to provoke statewide public interest. Justice Klingbiel gave three different accounts of his acquisition of 100 shares of stock in the Civic Center Bank & Trust Company, while Justice Solfisburg, in denying that he represented the bank secretly or otherwise, was forced to acknowledge that he too owned stock in the bank—700 shares. It looked bad.

From his war room overseeing the many moving parts of the case, Stevens found himself having to defend against a surprise rear guard attack—Sherman Skolnick, the very man who had started this whole process.

Shortly after the formation of the Special Commission, Skolnick had made it plain that he, like most of the public and members of the press, expected the handling of his allegations to be a “whitewash.” Skolnick even filed suit to disband the Special Commission and refused to be deposed, maintaining that the Commission’s lead attorney, Stevens, was doing the court’s bidding. It was a stunning and unexpected turn for Stevens, who needed Skolnick’s testimony. First, he had to know what Skolnick knew—and to get it under oath. But Stevens also had the veracity of the investigation to protect, and ignoring the accuser would feed the openly hostile public skepticism of the proceedings.

Stevens’s young charges were impressed with his refusal to be blindsided and his determination to press on. The gulf of a generation separated them. Stevens had enlisted in World War II in December of 1941, steadfastly decrypting Japanese radio traffic in the Pacific, before the others were born. Manaster sported a mop of wavy hair and impressive sideburns while Stevens preferred the close-cropped haircut of an astronaut. The tumult of the times—assassinations, political protests, an undeclared war in Vietnam, and the struggle for civil rights—further differentiated his young associates as a generation of change against an establishment of entrenched power, which was represented perfectly by the case before them. Yet they couldn’t help but be inspired by Stevens’s leadership. That he was confident and unwavering in the face of any setback caused them to strive to emulate his quiet example. They weren’t going to let him down under any circumstances.

Back at the Civic Center Bank, Manaster and Nussbaum dug into the haystack of documentation before them, Manaster with his lawyer’s eye for anything that smacked of evidence and Nussbaum carefully categorizing and collating. Eventually, two paper trails captured their attention.

The first involved Chief Justice Roy Solfisburg, who owned 700 shares of the Civic Center Bank. Of note, Solfisburg sold 300 of those shares soon after the court’s decision in People v. Isaacs, the case whose judgment was now under suspicion. That alone was enough to raise eyebrows, but Manaster and Nussbaum found an irregularity: The stocks had been sold for $24 a share while the sale was recorded at $25. It was a difference of $300—not a great deal of money, but a puzzling discrepancy. Manaster and Nussbaum had a hunch they could link this irregularity to Isaacs. Poring doggedly over microfilm records of transactions from Isaacs’s account at the bank, Manaster spotted a cancelled $300 check written to the bank, and dated May 26, 1967—the very next day after the criminal case against him was concluded in his favor. The young lawyer didn’t have to be a wartime code-breaker like his boss to know a clue when he saw one.

The second key discovery was a four-page handwritten list recording the distribution of stock to more than a hundred names. These were the final 12,850 shares in the bank, distributed mostly in lots of fifty or one hundred shares. Representing the last opportunity to invest in the bank, these shares would have been a valuable commodity, and the listed names reflected that privileged opportunity: judges, newspaper publishers, board chairmen, prominent attorneys, bank executives, and elected officials, including Illinois Governor Otto Kerner.

More importantly, there on page three was an entry of 700 shares to Roy J. Solfisburg Jr. in care of “Trust #931.” The transaction was recorded as May 27 1966—while People v. Isaacs was before Solfisburg and the court. Oddly, although Ray Klingbiel admitted to owning 100 shares, his name did not appear on the list. But the final 100 shares on the list had been distributed to Ted Isaacs on October 11, 1966—shortly after the case was argued and just before Klingbiel received his 100 shares from a mutual friend and prominent Illinois official named Robert Perbohner. Manaster and Nussbaum knew that if they could link Solfisburg’s 700 shares to Ted Isaacs, and those final 100 shares to Perbohner, they’d have their smoking gun tying Isaacs to the two justices.

Inquiries at the bank identified the author of the list as Jayne Kegley, a former secretary at the bank no longer employed there. Manaster was finally able to track her down on July 3, and persuaded her to meet him “as soon as possible” although it was already evening. They met at her home around 10:00 pm and she displayed what Manaster described as “an astonishingly good memory,” which Kegley herself boasted as “photographic.”

In other words, a perfect witness.

They went through the transactions on the list while Kegley identified who had instructed her to put each name on it. At nearly midnight, Manaster asked about the transfer of 700 shares to Roy Solfisburg via Trust #931. Kegley immediately recalled Ted Isaacs had directed that stock transfer.

Knowing how critical Kegley’s information might be, Stevens had told Manaster to call him after his visit no matter what the time. When Manaster called Stevens at home and told him what had transpired, Stevens knew it was important to get Kegley’s deposition on the record as soon as possible. Friday was the 4th of July, a holiday; but Kegley agreed to give her deposition on Saturday. The young, untried Manaster had never taken a deposition, and he was nervous. He needn’t have been. Under oath, Kegley was every bit as certain as she had been at home, recalling the sources of each transaction on the list. She also confirmed Isaacs’s personal involvement in the distribution of those 12,850 shares—essentially shares he controlled for his role in the bank’s capitalization.

Stevens now had a witness from the bank declaring under oath that Ted Isaacs had directed the issuance of stock to Justice Solfisburg while Isaacs’s case was pending before the court. It was damning evidence, and counter to the claims of both men.

Stevens had been unsure whether to make the presentation of evidence public. He’d been justifiably wary of Skolnick as the source of the allegations. Now on more solid footing, he was convinced that public hearings would be appropriate to allay widespread skepticism about the investigation. The Commission announced it would commence those hearings on Monday July 14, where testimony and evidence would be presented to the Special Commission in open court.

On July 6, The Cubs were pulling away in a pennant race with a 53-30-1 record, and headed to face the Mets, where they hoped to pad their six-game lead. But the once-hapless New York Mets came out of nowhere on their way to cutting Chicago’s division lead to four and a half games. Stevens’s opposition was even more dogged: the still recalcitrant Skolnick. On July 10 Skolnick filed motions challenging the court’s authority to force his deposition. When the judge ruled against him, Skolnick raised objections against being questioned “in secret,” which might allow Stevens to manipulate or hide his testimony. The judge ordered Skolnick to be allowed to be accompanied by others of his choosing at the deposition.

Liking nothing better than a circus, Skolnick showed up to Stevens’s office later that day with more than a dozen reporters and TV newsmen, who squeezed into the tiny conference room to the dismay of his partners. Skolnick made it clear that he considered Stevens and his staff “agents for the judges [who] would destroy everything we have spent months working on.” He and Stevens sparred for hours, a thrust-and-parry of pointed questions and tantalizing but vague replies. Transcripts show a determined but increasingly frustrated Stevens stymied by Skolnick’s intransigence to reveal his sources:

Skolnick: You are asking me to tell you everything I am privy to, to a committee that was set up to whitewash the judges.

Stevens: All I am asking for is the name of the person who may have relevant information about the matter under inquiry.

Skolnick: You are not going to get it.

Stevens: You are here on a solemn matter. I don’t think it is appropriate for you to put me off. I don’t like being put off.

Skolnick: I don’t trust you, you and the Commission…You are turning the Commission around to accuse me instead of the judges.

The deposition concluded with Stevens declaring his intent to obtain a court order to force Skolnick to cooperate, and Skolnick defiantly announcing that he’d go to prison first. The reporters in attendance gobbled it up, portraying Stevens as the man unjustly accusing the accuser. It irked Stevens to be considered the villain of this affair. That he was missing the Cubs’ greatest season in half a century might be seen to those who knew him best as nothing less than a heroic sacrifice.

Stevens had another deposition to take, and there was every reason to believe it would be an equally fruitless affair: Isaacs’s confidante, and the man from whom Klingbiel had claimed to receive his stock, Robert Perbohner.

Perbohner was a member of the Illinois Commerce Commission and a close friend of Isaacs with a reputation for favors—the tit for tat that oiled the machinery of commerce and politics. When first contacted by reporter Ed Pound in investigating Skolnick’s allegations, Klingbiel had claimed to receive the 100 shares of stock from Perbohner as a campaign contribution. But when Pound phoned Perbohner to corroborate Klingbiel’s story, Perbohner told him that he’d sold those shares to Klingbiel. Both men denied the stock had come from Isaacs. Further rousing suspicions, it was later discovered that the day after the story broke, Isaacs had flown to Woodruff, Wisconsin, to speak with Perbohner.

Perbohner had taken great pains to avoid being deposed. His attorney, Samuel Adam, claimed Perbohner incapable of being deposed due to being heavily medicated after recent hip surgery. Stevens spoke directly to Perbohner’s doctors in Woodruff, who believed the patient lucid and capable of answering questions. With that assurance, Stevens scrambled and found a Wisconsin court to issue a subpoena compelling Perbohner’s testimony.

On July 11, just three days before hearings were to commence, Stevens piloted his small private Cessna to Wisconsin to depose Perbohner. It was a chance for Stevens to clear his head in the open air, to defy literally if only momentarily the gravity of his situation. He arrived to find Perbohner’s hospital room crowded by Perbohner’s wife, his secretary, a court reporter, his lawyer Samuel Adam, and attorneys representing Klingbiel, Solfisburg, and Isaacs. The latter three’s presence there in Wisconsin was an indicator of how potentially damaging Perbohner’s testimony might be. If anyone allowed him to speak.

Adam reiterated his assertion that Perbohner was not fully competent to be deposed and directed his client not to answer any questions except his name and address. Despite his objections, Stevens, armed with a subpoena, began his interrogation. He asked Perbohner about his relationship with Isaacs, his involvement with stock in the Civic Center Bank, interactions with the two justices, and clarifications of his phone conversations with Ed Pound and other reporters. Perbohner’s replies were vague and contradictory, punctuated with objections from his lawyer and warnings not to reply. In one instance he called reporter Pound a liar while also claiming not to have spoken to him at all. Perbohner finally heeded his attorney’s advice and stopped answering altogether. Frustrated and effectively stonewalled, Stevens reluctantly ended the deposition and flew home.

Stevens’s failure to secure crucial testimony mirrored the suddenly luckless Cubs, who’d just suffered their sixth loss in seven games by surrendering four runs in the ninth inning against Philadelphia. Although the Cubs still led the NL East, the Mets were coming to town, and losing the series would cut Chicago’s lead—once as daunting as nine games—to two-and-a-half.

Stevens was missing an historic pennant race, but he wasn’t about to neglect his family. Regardless of the pressure and his workload, it was his habit to have dinner together and put his kids to bed. “My dad always tucked us in,” his daughter Sue recalled, “and he was the last one to give us a kiss good night.” But even at the tender age of six, she knew something was different that summer. “It was one of the few times that I remember him coming home tired.”

Public hearings would commence on Monday. In less than three weeks, Stevens’s team had reviewed reams of documents and taken twenty depositions, including all seven sitting justices, an unprecedented event in legal annals. They had a thousand-piece jigsaw puzzle, but whether they could put it together into anything resembling a clear picture of corruption remained to be seen.

Held in a large courtroom in downtown Chicago, the public hearings resembled a trial, with their presentation of evidence and testimony. But there were some key differences: The attorneys comprising the Special Commission sat at the judge’s bench, hurriedly expanded to accommodate all five; the jury box was filled with reporters, including Pound; while there in the middle aisle was Sherman Skolnick in his wheelchair. All told, ten lawyers sat at tables representing the three men designated “interested parties,” Klingbiel, Solfisburg, and Isaacs, as well as Stevens’s team.

Outside the proceedings, TV and radio reporters lined the hallways. An area of the building’s lobby was lined with microphones for pre- and post-hearing press conferences, largely commandeered by Skolnick. The man who shouted loudest about conspiracies and crooked judges was better press than the methodical presentation of complex financial matters unfolding in the courtroom. At stake were not just the careers of the two jurists, but as Chicago Today wrote, “the whole judicial system will also go on trial.” As for Stevens, his no-win situation was summed up by the Chicago Daily News: “For an attorney, the only job in Illinois more thankless than membership on the Special Commission … is the job as counsel for that commission. On the Commission’s chief counsel, John Paul Stevens … rests [that] burden.”

Stevens’s opening remarks were concise. He said he would present evidence and testimony relating to the facts of the case in order of their discovery. He knew that he didn’t necessarily have to prove the stock influenced the justices’ votes, but that their conduct in accepting and concealing its ownership was “an unacceptable appearance of impropriety.” And of course he had to tie the stock to Ted Isaacs, which the Kegley List would do.

Stevens began his witness testimony with the other state Supreme Court justices. Although records indicated a unanimous dismissal of the case against Isaacs, Stevens was surprised during his investigation to learn that the initial vote had ruled against Isaacs. He addressed his line of questioning accordingly to reveal that there had in fact been an earlier vote by the justices—one that would have upheld some of the original charges against Ted Isaacs.

With Justice Byron O. House on the witness stand, Stevens asked how Justice Klingbiel had come to write the Isaacs decision. House explained that cases were assigned on a simple rotation basis, and that People v. Isaacs had been assigned to Justice Underwood. In that first round of deliberations, Justices Underwood and Schaefer voted to reverse the case, effectively restoring the indictments against Isaacs. House, Solfisburg, and Klingbiel voted to affirm the lower court’s decision to acquit Isaacs, and Justice Kluczynski “passed,” wanting more time to decide. Needing four votes for adoption, Underwood’s opinion to reverse the conviction was rejected. House testified that under those circumstances, the case “goes back into the hat and goes to the next justice [in the rotation].”

That should have been Justice House. Instead, the case went to Klingbiel. In the absence of any reasonable explanation, it certainly seemed incriminating. Especially because with Klingbiel writing the decision the decision, Solfisburg, House and Kluczysnki joined him to create a majority to uphold the lower court’s decision to dismiss the charges against Ted Isaacs. But, House explained, Schaeffer and Underwood declined to join the new majority opinion—and both authored dissents. Because those dissents were unpublished, it appeared publicly that the opinion had been unanimous. More importantly, those dissents would have kept a dozen counts of the indictment alive against Isaacs…and without them Isaacs’s exoneration was complete.

To the outside observer, the passing of the case out of rotation appeared suspicious. It looked as if Klingbiel, then chief justice, had taken the case from Underwood and assigned it to himself in order to exonerate Isaacs. The Chicago Sun-Times went so far as to make that declaration, writing that “Klingbiel took the case back” after Underwood’s unfavorable opinion against Isaacs, from whom Klingbiel was alleged to have received valuable shares of stock in the Civic Center Bank.

It still remained for Stevens to tie Isaacs to that gift of stock, with Perbohner as intermediary. Calling his forensic accountant Nussbaum to testify, Stevens sought to introduce evidence he and Manaster had uncovered during their discovery at the bank. Nussbaum testified that, in exchange for Isaacs’s role in securing a bridge loan to complete the bank’s charter, Isaacs was issued 12,850 shares of stock. The subsequent distribution of those 12,850 shares was accounted for in the Kegley list. The list would link Klingbiel’s shares to Perbohner, who had received them from Isaacs, and Solfisburg’s shares directly from Isaacs and furtively to Trust #931.

But when Stevens attempted to introduce the Kegley list into evidence, Isaacs’s attorney objected. From the bench, Greenberg announced that he would postpone ruling on the list’s admissibility until a later time.

It was a frustrating setback. And further evidence to an already mistrustful Skolnick that the Special Commission was in fact acting on behalf of the justices in a cover-up.

This is how it works.

Stevens and his team left the courthouse together for the slow walk back down LaSalle Street to Stevens’s office. This was their routine as they came and went, careful not to speak about the case lest they be overheard by reporters or local lawyers. They passed the famous Picasso sculpture in the plaza outside, the great artist’s gift to what he called, “one of the great gangster cities.” Just a year earlier on the eve of the 1968 Democratic National Convention, activists Jerry Rubin, Phil Ochs, and other so-called “Yippies” were arrested at the Picasso, where they’d just nominated a pig for president of the United States. Stevens’s team passed a dozen bars in the Loop where other lawyers unwound after their day in court—but Stevens wasn’t the “unwinding” type, and there was work to be done in preparation for tomorrow.

Hearings resumed Tuesday morning with Nussbaum’s testimony on the 12,850 shares. Displaying his meticulous charts and blow-ups of documents, Nussbaum was able to match the names on the list to the names on the stock certificates issued by the Civic Center Bank. The last sale of the final 100 shares of stock was made on October 11, 1966, to Ted Isaacs. Although purchased by Isaacs, Nussbaum’s review of the bank’s transactions revealed that those stock certificates were issued to Bob Perbohner.

It was Jayne Kegley’s list, still pending admissibility, that tied all 12,850 shares to Isaacs, including the critical distributions to the two justices. Stevens pleaded his case to Greenberg, arguing, “The bank, it doesn’t seem to me, can in good grace produce this document in response to this subpoena from its own files, and then question its authenticity.”

Greenberg agreed, and the Kegley list was admitted into evidence. Now it remained for Jayne Kegley to confirm, as she had in her initial visit with Manaster and again in her deposition, the steel-trap memory that linked her former boss, Ted Isaacs, to the key transactions that wound up with Justices Klingbiel and Solfisburg.

Kegley was called to testify. Although no longer employed by the Civic Center Bank, her responsibilities there had included preparing lists of original stockholders and the issuance of stock certificates. She worked closely with bank president Harold Stout, and Ted Isaacs, then a member of the board, an officer of the bank, and the bank’s attorney, and a small handful of other board members. She confirmed her handwritten list of stock recipients, and that she’d been instructed verbally as to the distribution of shares primarily by several bank officials.

Yet she seemed suddenly uncertain about Ted Isaacs’s involvement. When pressed about the entry for Trust #931 and Roy Solfisburtg, she testified “I thought perhaps [it] came from Mr. Isaacs, but I cannot say definitely that it did…Remember, we are talking about something that took place more than three years ago.”

Stevens’s primary witness, with her photographic memory for names, dates, and sums, was deserting him.

Confronted with her deposition, Kegley was asked to read aloud into the record key pages that had firmly identified Ted Isaacs as the person who told her to put Solfisburg on the list. She did, but added that she couldn’t be certain. The uncanny memory of which she’d been so proud was suddenly not so extraordinary.

Asked when she had last spoken to Mr. Isaacs, she replied “Last week.” After her deposition, Kegley confirmed.

The implication was clear. Isaacs had gotten to her.

Stevens’s co-counsel Torshen tried a different tack. He asked Kegley to go through all four pages of the list and identify names other than the Solfisburg and Klingbiel/Perbohner transactions. Without hesitation, she was able to identify the person who had instructed her for the vast majority of the names, faltering only over the two transactions to the judges. The point was made: Jayne Kegley’s memory loss was selective in the instance of Ted Isaacs. It was so evident that she was covering for her old boss, the headline for the next day’s Alton Evening Telegraph declared unequivocally, “Isaacs Paid for Judges’ Stock.”

It was time to hear from the justices themselves. In a late evening session, Justice Solfisburg took the stand at 8:00 pm. While the witness stand certainly would have been a new courtroom perspective for him, he seemed well at ease, supremely confident, a man for whom the system ensured he had nothing to fear.

This is how it works.

In beginning his testimony, Solfisburg emphasized that his recollection of events was “limited.” He proved evasive and unclear, and frequently couldn’t recall events in question. On those occasions when he was certain of something, Stevens caught him in inconsistencies. The chief justice testified that he had purchased his CCB Stock thinking it a good investment, claiming he knew nothing of Isaacs’s connection with the bank. Stevens presented Solfisburg with the envelope in which he received, signed, and returned his CCB Proxy note, asking him to read the return address aloud. Solfisburg was chagrined to read the name of Isaac’s firm, “Burton, Isaacs, Bockelman & Miller” into the record.

Stevens moved on to the establishment of Trust #931 for the purposes of concealing ownership. Solfisburg denied this, claiming that the trust was created not for subterfuge but for his children’s education. Stevens shredded that claim, reminding the Commission that after selling his stock, Solfisburg closed the trust.

Stevens then went to the heart of the matter of impropriety, asking Solfisburg if, when he’d purchased stock in the Civic Center Bank, he was aware that the Isaacs case was pending before the court. Solfisburg gave a long, meandering reply, acknowledging only that he may have read about the case in a newspaper. Visibly shaken at this point, the chief justice attempted to pour himself a glass of water from a pitcher set by the witness stand and accidentally drenched himself. His earlier confidence washed away, Manaster described Solfisburg in that moment as “suddenly and for the first time, [looking] like an ordinary man in a lot of trouble.”

On Wednesday July 16, while millions of Americans watched Apollo 11 lift off for the moon, Stevens, up since 4:00 am, was preparing to call Justice Klingbiel to the witness stand later that morning. In contrast to the evasive Solfisburg, Klingbiel’s testimony was candid and regretful, although he denied any wrongdoing. He admitted an acquaintance with Bob Perbohner but claimed he barely knew Ted Isaacs. He admitted lying to reporters that he purchased the stock. (The confession must have pleased reporter Ed Pound; the next day’s headline declared, “Kingbiel Admits He Lied to Telegraph.”) He claimed that the hundred shares he received from Bob Perbohner were a campaign donation—made at a party in November of 1966, while Isaacs was before him, with the furtive passing of an envelope. In an election that had already concluded, and in which Klingbiel ran unopposed. This is how it works.

Ten months later, Klingbiel transferred the stock to his grandchildren’s names, which is how it had come to the attention of Sherman Skolnick while reviewing public stock records. Prior to that, Klingbiel had failed to report or register the stock. He also admitted to calling Perbohner when the story broke to ask if the stock came from Isaacs, which Perbohner denied. But Nussbaum’s testimony, along with the Kegley list, had already shown that Isaacs paid for the stock. These last 100 shares would have been a valuable commodity; there’d be no more shares issued. And yet they wound up in Justice Klingbiel’s hands while People v. Isaacs was before the court.

Klingbiel concluded his testimony by wishing he had done things “differently.” It was a tacit admission, if not of guilt, at least of the appearance of impropriety.

But Stevens wanted to leave no room for doubt, and the man whose allegations had started this investigation claimed to have well-sourced informants and “dynamite” that would blow the investigation wide open. Before putting Skolnick on the witness stand, Stevens needed to ensure that he did in fact have information pertinent to the investigation. On Thursday July 17, a judge compelled Skolnick to comply with the subpoena ordering his deposition. Once again, Skolnick refused, and the judge declared him in contempt. It was exactly what Skolnick wanted.

Skolnick was sentenced to four months in the county jail and his bail set at $1,000. He only needed to post a $100 bond to be released, but Skolnick had no interest in seeking his freedom. He was delighted to be publicly martyred, and for the chance once again to portray Stevens and the Commission as villains. To many, Skolnick’s jailing vindicated his claim that the Commission was nothing more than a sham intended to exonerate the judges.

As Skolnick was lifted, in his wheelchair, into a paddy wagon bound for jail, Stevens and the Commission were blasted in the press. The New York Times wrote, “The first person punished as a result of the investigation was the man who started it.” The ACLU called for a “probe of the probers”—an investigation of Stevens—for the jailing of Skolnick.

Skolnick’s father called Stevens’s office to express his concern that his disabled son could not physically cope with the hardship of jail time. Stevens found himself in the unenviable position of being both Skolnick’s persecutor and his only savior. As it turned out, comedian and activist Dick Gregory, Skolnick’s friend and fellow agitator, got everyone off the hook when he paid Skolnick’s bond. When asked where he got the money, Gregory joked, “I borrowed it from the Civic Center Bank.” Skolnick later admitted that he’d given Gregory the $100 to pay his bond. Free, Skolnick continued to milk the publicity, appearing on a popular late-night TV show and showing off the fingerprint ink still on his hands.

That weekend, the best and worst of this tumultuous time in America were in evidence in historic headlines. On Saturday, July 19, Mary Jo Kopechne drowned in Ted Kennedy’s car at Chappaquiddick. The very next evening, the nation watched in awe as Apollo 11 astronauts Neil Armstrong and Buzz Aldrin landed safely on the moon. Throughout the events of that weekend, Stevens continued his work from the dining room table at home, filling legal pads with illegible scribblings only he could read, working a number-two pencil to a nub. His wife Betty busied herself with a scrapbook of newspaper clippings—not of the Apollo mission or other historic events of the time, but local newspapers’ coverage of her husband’s courtroom exploits.

Frank Greenberg convened Monday morning’s hearings by asking for a moment of silence for the astronauts’ safe return before Stevens called his first witness, Civic Center Bank President Harold Stout. Stevens was also looking to plant a flag of sorts. The removal of a justice for judicial misconduct was a rare if not unprecedented event; only once in Illinois state history had a sitting state judge been impeached—nearly thirty years before the start of the Civil War. Impeachment was one possible outcome here, and certainly both justices’ removal was a likely consequence if Stevens made his case. That he took them on at all was as unimaginable to some as attempting to walk on the moon.

Stevens used Stout’s testimony to clarify or refute aspects of Roy Solfisburg’s account of his stock acquisition. Stout testified that he’d never heard of Solfisburg or Perbohner until this case broke. He confirmed the veracity of the Kegley list and stated that the immediate goal was to issue those last remaining shares, in increments of fifty to one hundred, to prestige investors who might bring new business to the bank. When Stevens pointed out that Solfisburg was allowed to buy 700 shares—a large purchase for someone with no other business at the bank—Stout had no explanation. When asked about placing them in a trust, Stout said that he was unaware of any sale to any trust, and that it would have been contrary to the bank’s usual practices.

Stevens’s implication was clear: What the justice’s attorneys were attempting to characterize as ordinary business transactions were in fact quite out of the ordinary at every turn.

There was only one more important witness to hear from: Ted Isaacs.

Although described by the Daily News as, “smiling and cordial [and] brief,” Isaacs’s testimony was, like Solfisburg’s, peppered with uninformative replies and a selectively faulty memory. Although he admitted an active friendship with Perbohner, he said they seldom met in person as they conducted their business in different parts of the state. That statement inadvertently made his sudden flight to see Perbohner the day after the story broke that much more suspicious.

Stevens asked about the 100 shares of stock Isaacs had purchased for Perbohner in the fall of 1966, when People v. Isaacs had begun oral arguments in the Illinois Supreme Court. Isaacs claimed he was repaying a loan Perbohner had made to him in March of 1965, in the amount of $2,000 to assist him with unexpected legal expenses. This was the crux of Isaacs’s alibi: that at $20 a share, the 100 shares he gave to Bob Perbohner in October of 1966 were nothing more than the repayment of a debt. That those shares wound up with Justice Klingbiel just a few weeks later had nothing to do with Isaacs, who insisted what Perbohner did with them was solely up to Perbohner.

Stevens was prepared to challenge this alibi. Again, Nussbaum produced his poster-sized charts of documents and transactions, this time showing Perbohner’s accounts. Those exhibits show no disbursement of $2,000 in cash or check, or any record of a loan. It simply didn’t happen.

Pressed about Solfisburg’s 700 shares, Isaacs insisted he had only a limited role in the bank and no knowledge of the distribution of stock to Solfisburg. Stevens reminded the Commission that Kegley had identified Issacs as the source of her instructions. Isaacs denied any connection to or interest in Solfisburg’s shares whatsoever. Once more, Stevens looked to Nussbaum to display another exhibit: a blow up of the check for $300 written by Ted Isaacs to the Civic Center Bank the day after People v. Isaacs concluded. That $300 was exactly the difference between the going price of the CCB shares and the lesser sum paid by the purchasers. And Isaacs made up the shortfall out of his own pocket.

Faced with the evidence of his own check to the bank, Isaacs attempted to explain. He’d simply made a mistake quoting a $24 share price to the purchasers and, when contacted by the bank about the discrepancy, claimed he was “embarrassed” and felt an obligation to make up the difference. He insisted not to know the seller was Justice Solfisburg. Stevens saw it differently, arguing that it was damning evidence against Isaac’s claim that he didn’t have anything to do with Solfisburg’s shares, that the justice’s purchase and sale were completely independent of Isaacs.

Isaacs would not be shaken from his story. He made it clear that he believed his opaque testimony had thwarted Stevens. When Stevens asked, perhaps rhetorically, “So there is really no possible way to verify the details of this transaction except by the recollection of the person involved?” Isaacs replied smugly, “Yes, sir, that is right.” He was imperious to the end. Stevens dismissed him.

Stevens had done all he could. The next day, he’d make his closing arguments to the Commission. As they once again passed through a Loop bristling with after work camaraderie, Stevens’s young team would have fit right in among them; after six weeks of tenacious legal toil, they had more than a little steam to let off. Instead, they’d share a different kind of companionship as they worked together into the early morning hours under Stevens’s precise direction.

Five weeks and thirty-five Cubs games had passed since the call summoning John Paul Stevens to what he’d felt was his duty, despite the potential consequences to his career. He now had to summarize his intense few weeks of investigation and six days of hearings by presenting his findings. A packed courtroom listened as Stevens outlined the facts of the case that had called the “integrity of the judgment” in People v. Isaacs into question in Sherman Skolnick’s petition.

Stevens asserted that Isaacs, Perbohner, Klingbiel, and Solfisburg were all guilty of gross impropriety. He focused on inconsistencies in testimony and convenient memory lapses by the witnesses, as well as an incriminating lack of customary documentation. Despite contradictory statements, Solfisburg and Isaacs were in fact acquainted, and Solfisburg knew of Isaacs’s association with the Civic Center Bank. The loan from Perbohner, which Isaacs had claimed was repaid in shares of stock, was undocumented: no receipt, no withdrawal, no request for payment or even a thank you note from the recipient. Stevens similarly pointed to inconsistencies as to how those shares went to Klingbiel, who initially claimed to have purchased them only later to declare them a campaign contribution—also undocumented.

“Over and over again in the record, transactions are handled in a way that is not the normal way to handle them,” Stevens argued, making it clear that the purpose of that extraordinary behavior was to conceal the true nature of those transactions.

In summary, Stevens invoked two legal principles, the first being “that affirmative acts of concealment are evidence of consciousness of guilt.” The second principle was that, in the absence of direct evidence, an unlawful agreement may be inferred “from the evidence of more than a coincidental sequence of events.” To back up that assertion, Stevens read from an earlier decision by the Illinois Supreme Court:

“A conspiracy is rarely susceptible of direct proof, but must very nearly always, from the nature of things, be established by circumstantial evidence and legitimate inferences arising therefrom. The inferences depend largely upon the commonsense knowledge of the motives and intentions of men in like circumstances.”

The author of that quote was Justice Ray Klingbiel.

This, it was as if Stevens were saying, is how it’s supposed to work.

On July 31, one week after the conclusion of the hearings, the Special Commission released its sixty-one-page report. Reporters and courtroom observers quickly turned to the last page to read: “The appearance of impropriety is so substantial and pervasive in the case of both justices that they must … be held clearly to have violated the Canons of Ethics of the Illinois judicial conference.”

There was no waffling. The report was a scathing condemnation of both justices, further stating “Klingbiel's acceptance of stock from Perbohner, a member of the Illinois Commerce Commission, which was a litigant in three pending cases, was an act of impropriety. His concealment of the stock violated the Canons of Ethics.” As for Solfisburg, the report was even more overt in its conclusion, stating, “At a time when Isaacs was a litigant before him, Solfisburg was granted favored treatment in acquiring 700 shares via the influence of Isaacs. The ‘extraordinary manner’ of these transactions violated the Canons of Ethics. The Commission deems his testimony ‘wholly incredible.’”

They had just called the chief justice of the Supreme Court of Illinois a liar.

The Commission went on to conclude that public confidence in the courts could only be restored by the two justices resigning. Both justices initially refused. But that weekend, Justice Solfisburg submitted his resignation from the court; only hours later, Justice Klingbiel announced his retirement from the judiciary. Both men had also attracted the attention of the IRS, which began an investigation into possible federal violations.

As a result of the report, Ted Isaacs was “temporarily relieved” of his duties at the bank. The court, however, refused to vacate the judgment in the case, effectively exonerating Ted Isaacs yet again. In 1974, Isaacs was disbarred and imprisoned on charges of bribery, tax evasion, perjury, and conspiracy in yet another stock scandal.

Bob Perbohner refused to resign from the Illinois Commerce Commission, but was removed by the governor for “incompetence and neglect of duty.”

Ed Pound, the young reporter from Alton, Illinois, recalled his exuberance: “I mean, God, we did it—this little tank town newspaper in the middle of Zilchville, taking on the big boys and we did it.” Pound was nominated for a Pulitzer Prize for his investigative reporting that led to the downfall of the two justices.

Even an astonished Skolnick was forced to admit that Stevens and the Special Commission “did a pretty good job, [acting] at great risk to themselves.” But he couldn’t do so without claiming credit for their performance, saying, “I would say the criticism that we made of the Greenberg Commission earlier in a way forced them to get a little backbone into the matter, and to do what they finally ended up doing.”

Only Stevens, it seemed, remained troubled by the affair, later recalling it as “a sad event. You really cannot be happy about that kind of an outcome…although certain good has come out of it in the long run, it’s not a chapter of our history that we can be proud of.”

John Paul Stevens became nationally known as a corruption fighter, and his prominence in the Special Commission led directly to his appointment to the United States Court of Appeals by President Richard Nixon in 1970. Five years later, he was confirmed to a seat on the United States Supreme Court. Were it not for the allegations of a strange little conspiracy theorist in Chicago, Illinois, Stevens’s ascension to the Court might never have happened.

Manaster, who enjoyed a life-long friendship with Stevens and wrote a book about the case, Illinois Justice, later said, “This was the rare, probably unique, instance in which a particular case on which a lawyer worked became the catalyst for his ascent to the US Supreme Court.” Stevens himself agreed, remarking at a 1992 speech to the American Bar Association, “Had I not participated in that particular pro bono matter, I’m sure I would not be occupying the position I occupy today.”

The day after his nomination to the Supreme Court, the New York Times wrote, “Several persons interviewed yesterday declined to characterize Judge Stevens in political terms, saying that the customary labels did not seem to suit him.” He’d go on to be confirmed 98-0 in a Senate with 61 sitting Democrats. Stevens seems an almost quaint anachronism in our current era where the votes of Supreme Court justices can practically be counted before a decision based on political leanings. But Stevens, a lifelong Republican, was no ideologue. Guided by the rule of law and judging cases on the individuality of their merits, he often found himself to the left of fellow justices appointed by Democratic presidents, including Ruth Bader Ginsburg. Across 35 years on the Court, he voted to protect the rights of immigrants and women, in favor of detainees at Guantanamo, against mandatory prayer in schools … and that “a sitting president is not exempt from litigation against him.”

He also recalled the lessons learned in that long-ago Chicago summer. Stevens believed in the rights of the so-called pro se litigant—the Skolnicks of the world who deserve to be heard. He believed in Equal Justice Under Law as more than words etched on the Supreme Court building. He believed that, for justice to flourish, few matters were as important as confidence in our courts.

That belief can be heard in his scathing dissent in the Supreme Court’s Bush v. Gore decision to halt the recount of Florida votes during the 2000 presidential election, a decision which he believed cast unjustified doubt on the integrity and impartiality of our nation's courts. Stevens wrote, "It is confidence in the men and women who administer the judicial system that is the true backbone of the rule of law … Although we may never know with complete certainty the identity of the winner of this year's Presidential election, the identity of the loser is perfectly clear. It is the Nation's confidence in the judge as an impartial guardian of the rule of law."

Long after he retired from the bench in 2010, he continued to surprise observers on hot button issues. After the Parkland shooting in 2018, the 98-year old Stevens wrote a New York Times op-ed declaring the so-called right to bear arms "a relic of the 18th century," and called for its repeal. During confirmation hearings for Brett Kavanaugh, Stevens was outspoken in his opposition, telling an audience in Florida, “I thought Brett Kavanaugh had the qualifications for the Supreme Court. I've changed my views…Kavanaugh’s performance during the hearings caused me to question his fitness to serve.”

In presenting Stevens with the Medal of Freedom in 2012, President Obama said of him, “Justice Stevens applied, throughout his career, his clear and graceful manner to the defense of individual rights and the rule of law, always favoring a pragmatic solution over an ideological one.” President Gerald Ford, the Republican who nominated him to the bench in 1975, similarly lauded Stevens for “carrying out his judicial duties with dignity, intellect and without partisan political concerns.”

On July 16, 2019—exactly fifty years after the Apollo 11 mission lifted off for the moon—John Paul Stevens passed away at age 99 at his home in Florida. In retirement, Stevens had continued to root for his beloved Chicago Cubs, who’d broken his heart again when they ultimately lost the 1969 pennant race to the New York Mets. He attended the 2016 World Series at Wrigley Field with his grown daughter, Sue, a practicing attorney herself, when the Cubs finally won their first World Championship since 1908.

Truly*Adventurous, all rights reserved. For inquiries email us here.

Ken Pisani writes for film and television and has earned awards and an Emmy nomination for adapting compelling true stories. He’s also a playwright and author, and finalist for the 2017 Thurber Prize for his Los Angeles Times best-selling debut novel AMP’D. His new novel, The Defection and Subsequent Resurrection of Nikolai Pushkin, is comic historical fiction about a Soviet defector in the tumultuous year of 1989.